The landscape of credit cards is continually evolving, with increasing emphasis on security protocols. While Verified by Visa (VBV) has been a prevalent authentication method for online shopping security, a segment of the market requires, or prefers, credit cards that do not mandate its use. This article provides a detailed examination of financial products – specifically, unsecured credit cards – that function effectively without VBV, alongside a comparison of leading card issuers and considerations for prospective cardholders.

Understanding the VBV Alternative & Security

VBV, designed to add a layer of security to online transactions, isn’t universally accepted or preferred. Some merchants don’t support it, and some cardholders find it cumbersome. No VBV options often rely on alternative fraud detection mechanisms, including advanced algorithms, transaction monitoring, and robust fraud protection measures implemented by the card issuer. These include address verification systems (AVS) and real-time risk assessment. It’s crucial to understand that the absence of VBV does not equate to diminished security; rather, it signifies a reliance on different, equally effective safeguards.

Types of Credit Cards Available

Several categories of credit cards are available without mandatory VBV verification:

- Cash Back Cards: These rewards cards offer a percentage return on purchases, appealing to those prioritizing direct monetary benefits.

- Travel Rewards Cards: Designed for frequent travelers, these cards accumulate points or miles redeemable for flights, hotels, and other travel expenses. Card benefits often include travel insurance and airport lounge access.

- Balance Transfer Cards: These cards allow users to consolidate high-interest debt from other credit cards, often with a 0% introductory APR;

- Alternative Credit Cards: Targeted towards individuals with limited or damaged credit history, these cards assist in building credit, though they may have lower credit limits and higher APRs.

Key Considerations When Choosing a Card

Selecting the optimal credit card necessitates careful evaluation of several factors:

Financial Terms

- APR (Annual Percentage Rate): The interest rate charged on outstanding balances. Pay close attention to both the purchase APR and any penalty APRs.

- Fees: Scrutinize potential fees, including annual fees, late payment fees, and foreign transaction fees.

- Credit Limit: The maximum amount you can charge to the card.

- Payment Options: Understand the available methods for making payments (online, mail, phone).

Card Features & Benefits

- Card Benefits & Perks: Evaluate additional benefits such as purchase protection, extended warranties, and concierge services.

- Rewards Programs: Assess the value and redemption options of any rewards cards programs.

- Digital Wallet Compatibility: Ensure compatibility with popular digital wallets like Apple Pay and Google Pay.

Creditworthiness

Your credit score significantly impacts your approval odds and the terms you receive. A higher credit score generally qualifies you for cards with lower APRs and better rewards. Responsible spending habits are crucial for maintaining a positive credit history.

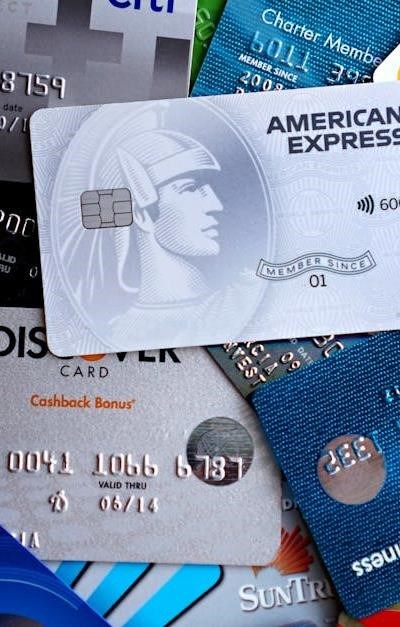

Top Card Issuers (Non-VBV Options)

(Note: Specific card availability and features change frequently. This is a snapshot as of late 2023. Always compare cards directly with the card issuer.)

- Capital One: Offers a range of cards with strong rewards and security features, often without requiring VBV;

- Discover: Known for its cash back rewards and excellent customer service.

- American Express: Provides premium rewards cards with extensive card benefits, though acceptance may vary.

The Application Process & Cardholder Agreement

Credit card applications are typically available online or through the card issuer’s website. Thoroughly review the cardholder agreement before applying, paying particular attention to the terms and conditions, fees, and dispute resolution procedures.

Ultimately, choosing the best credit cards requires a personalized assessment of your financial needs, spending habits, and credit score. Prioritizing security, understanding the terms, and utilizing the card responsibly are paramount to maximizing its benefits.

This article presents a thoroughly researched and lucid overview of the unsecured credit card landscape for consumers seeking alternatives to Verified by Visa. The delineation between VBV’s function and the compensatory security measures employed by issuers – specifically, the emphasis on AVS and real-time risk assessment – is particularly well articulated. The categorization of card types (Cash Back, Travel Rewards, Balance Transfer, and Alternative Credit) provides a practical framework for prospective applicants. A valuable resource for informed financial decision-making.

A commendable analysis of a frequently overlooked aspect of credit card functionality. The author correctly identifies the growing demand for cards unburdened by VBV requirements, and effectively addresses the common misconception that its absence implies reduced security. The discussion of alternative fraud detection methodologies is both comprehensive and reassuring. Furthermore, the article’s neutral tone and focus on objective comparison of card issuers enhance its credibility and utility for a discerning readership. Highly recommended.